Blog Categories

- Accounting and Payroll Service

- Best Metrics for Key Performance Indicators

- Best Practices for Invoice Factoring

- Cash Flow

- Compliance

- Extending Credit to Customers

- Factoring

- How to Identify a Business Partner

- Increase Cash Flow

- Money Saving Tips

- Purchase Order Financing

- Setting Priorities

- Small Business Decision-Making

- Small Business Lending

- Small Business Management

- Tech Tools for Small Business

- The Need for Optimism

3 Rules to Successfully Applying For Accounts Receivables Financing

Some things are just fine when done quick and dirty. You could count among them: Weekday breakfasts, meeting recaps and the greetings on a postcard sent from vacation.

But if your business is searching for financing, this is not a process that can be given the quick and dirty.

The array of firms that offer accounts receivable financing is vast and varied. Choose a firm that has earned a reputation for taking care of clients in a range of industries.

Regardless of the firm you choose for accessing capital, the application process takes time and effort, so here is a heads up on what to expect, before you walk scattershot among factoring firms.

Rule #1: Disclose everything in your application for invoice financing

Be as honest and rigorous as possible in your application, since the quality of communication and the degree to which you lay out your firm’s margins and sensitivities, will condition the tone of an ongoing dialogue (and potentially, a partnership). If your documentation paints a picture of a firm on the steel-plated end of a velvet rope, it will not serve you well; be open and forthcoming in disclosing relevant details.

Rule #2: Get your papers in order before applying for accounts receivable financing

Certain questions will come up in the application process. To the extent that you are prepared with the documentation, it will make the application for accounts receivable financing that much easier.

It has been our experience in reviewing many applications, that a firm that was doing swimmingly just two months ago can have legitimately run into challenges and suddenly need working capital. Such a company can be an ideal candidate for funds, if it does not skirt around the issues and presents the current operational picture clearly.

Center your preparation around the items below, which will likely be requested in the application for funding by any high-quality firm.

- Basic business questions regarding outstanding liens and back taxes

- Amount of receivables in the last 30 days

- Who are the largest customers of the business?

- An updated balance sheet and income statement.

- Accounts receivables aging report

- Recent tax returns of the business

These documents, taken together, can help paint an accurate picture of the firm’s financial situation and enable the factor to determine the best course of action.

Rule #3: Place a call when you are applying for accounts receivable financing, to judge the fit

It may seem self-evident, but you want to start discussions with the potential financing firm as soon as possible, so pick up the phone and talk turkey. Get a sense of who are the principals and what their approach is.

A partnership that is remarkable starts with stellar communication. Email has its place, but is no substitute for meaningful dialogue. Call them up to see how they can empower your business.

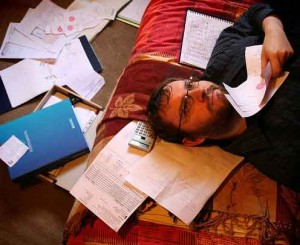

Photo courtesy of Creative Commons 2.0, Practicalowl.

Great tip there! Applying for any financing is like applying for a job. You need to be always ready, bring the necessary documents and be ready for the questions. Answer truthfully, after all these finance people will somehow know eveything about you and your financial status and stability.

This blog was… how do I say it? Relevant!! Finally I have found something which

helped me. Cheers!

Fantastic! We’re happy to help and hope you continue reading!